In a significant stride toward simplifying Goods and Services Tax (GST) compliance, the Goods and Services Tax Network (GSTN) has rolled out a much-anticipated feature. This latest enhancement allows newly registered Goods Transport Agencies (GTAs) opting for Forward Charge to file Annexure-V seamlessly on the GST Portal. Let's delve into the key aspects of this groundbreaking feature and understand how it promises to streamline tax filing for GTAs.

| Table Section |

|---|

| 1. Introduction |

| 2. Significance of Online Annexure-V Filing |

| 3. Key Deadline |

| 4. Accessing the Feature |

| 5. Flexibility in Choosing Tax Options |

| 7. FAQs |

| 8. Conclusion |

The Significance of Online Annexure-V Filing:

GTAs have long awaited a more streamlined process for tax compliance, and the introduction of online filing for Annexure-V addresses this need. This feature is tailored for newly registered GTAs opting for Forward Charge and facilitates the digital submission of Annexure-V, eliminating the complexities associated with traditional manual filing methods.

.jpg)

Key Deadline:

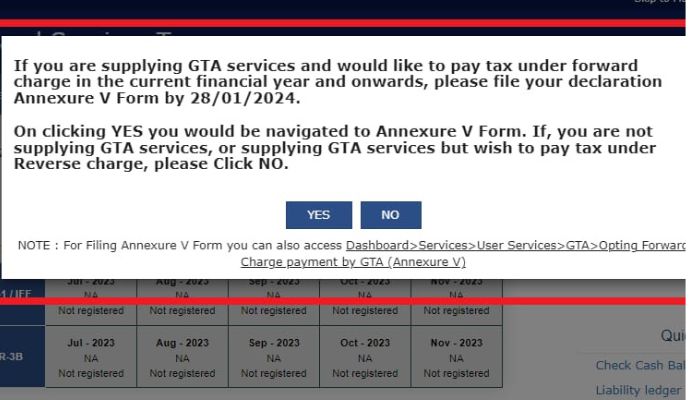

For GTAs providing services and intending to pay tax under Forward Charge for the current financial year and beyond, adherence to the January 28, 2024 deadline for filing the Annexure V Form is crucial. This deadline underscores the importance of staying current with the new online filing option to ensure timely compliance.

Accessing the Feature:

Accessing the online filing option is user-friendly and can be initiated by selecting "YES" when prompted. Alternatively, users can effortlessly navigate to the Annexure V Form through the Dashboard by following this path: Services > User Services > GTA > Opting Forward Charge payment by GTA (Annexure V). This ensures that GTAs can efficiently leverage the online filing feature.

Flexibility in Choosing Tax Options:

GTAs are empowered with the flexibility to choose between Forward Charge and Reverse Charge. If a GTA is not engaged in providing GTA services or prefers tax payment under Reverse Charge, a simple selection of "NO" during the filing process aligns the system with their specific business requirements.

(FAQ)

Q1: What is Annexure-V, and why is it significant for newly registered GTAs opting for Forward Charge?

A1: Annexure-V is a crucial component in the Goods and Services Tax (GST) compliance process, specifically designed for newly registered Goods Transport Agencies (GTAs) opting for Forward Charge. It allows for the seamless online filing of tax-related declarations, replacing traditional manual methods and enhancing the efficiency of the filing process.

Q2: Why is the recent feature introduced by GSTN for online filing of Annexure-V considered a significant development for GTAs?

A2: The introduction of the online filing feature by GSTN is a long-awaited and significant development for GTAs. It simplifies the tax compliance process by enabling newly registered GTAs opting for Forward Charge to digitally submit Annexure-V. This not only streamlines the filing process but also aligns with the broader digitalization initiatives in taxation.

Q3: What is the deadline for GTAs to file the Annexure V Form online, and why is it important to adhere to this deadline?

A3: The deadline for GTAs to file the Annexure V Form online is January 28, 2024. It is crucial to adhere to this deadline to ensure timely compliance with the new online filing option. Filing before the deadline is essential for GTAs providing services and intending to pay tax under Forward Charge for the current financial year and beyond.

Q4: How can GTAs access the online filing option for Annexure-V, and what alternative path is provided on the GST Portal?

A4: GTAs can access the online filing option for Annexure-V by selecting "YES" when prompted. Alternatively, they can navigate to the Annexure V Form through the Dashboard by following the path: Services > User Services > GTA > Opting Forward Charge payment by GTA (Annexure V). This user-friendly approach ensures easy access to the online filing feature.

Q5: Is there flexibility for GTAs in choosing tax options, and how can they indicate their preference during the filing process?

A5: Yes, GTAs have flexibility in choosing between Forward Charge and Reverse Charge. During the filing process, GTAs can indicate their preference by selecting "YES" if they wish to pay tax under Forward Charge or "NO" if they are not involved in providing GTA services or prefer to pay tax under Reverse Charge. This flexibility caters to the diverse needs of businesses in the GST landscape.

Q6: Can GTAs still file Annexure-V online if they have previously submitted manual forms to the jurisdictional office?

A6: Yes, the new online filing feature is designed to accommodate manual Annexure-V submissions that may have been made to the jurisdictional office before the commencement of the online filing option. This ensures a smooth transition for GTAs who may have already submitted manual forms.

Q7: How does the online filing of Annexure-V contribute to the overall efficiency of the GST compliance process for GTAs?

A7: The online filing of Annexure-V contributes significantly to the overall efficiency of the GST compliance process for GTAs. It eliminates the need for manual paperwork, streamlines data submission, and enhances accuracy. This, in turn, saves time and resources, allowing GTAs to focus on their core business operations.

Q8: Is there any assistance provided on the GST Portal to guide GTAs through the process of opting for Forward Charge and filing Annexure-V online?

A8: Yes, the GST Portal offers a user-friendly interface that guides GTAs through the process of opting for Forward Charge and filing Annexure-V online. The path on the Dashboard (Services > User Services > GTA > Opting Forward Charge payment by GTA) is designed to provide easy access, ensuring that GTAs can navigate through the process seamlessly.

Q9: Can GTAs change their tax preference from Forward Charge to Reverse Charge or vice versa after filing Annexure-V online?

A9: The online filing system allows flexibility for GTAs to choose their tax preference during the filing process. However, once the Annexure-V Form is submitted online, it is essential for GTAs to carefully consider their tax preference as changes post-submission may have specific procedures or timelines.

Q10: How does embracing this technological advancement in online filing benefit GTAs in the long run?

A10: Embracing the technological advancement of online filing for Annexure-V benefits GTAs by providing a more efficient, transparent, and user-friendly platform for tax compliance. It aligns with the evolving landscape of GST, facilitating a seamless approach to filing and positioning GTAs to adapt to future developments in taxation procedures.

Conclusion:

The introduction of the online filing feature for Annexure-V by GSTN is a commendable leap towards facilitating a more efficient and transparent taxation system. Newly registered GTAs opting for Forward Charge are encouraged to embrace this technological advancement, ensuring timely compliance with the January 28, 2024 deadline for Annexure V Form submission. As businesses adapt to evolving GST landscapes, leveraging these innovative features becomes imperative for fostering a seamless and compliant approach to taxation. Embrace the future of tax filing with GSTN's latest online filing feature for Annexure-V.