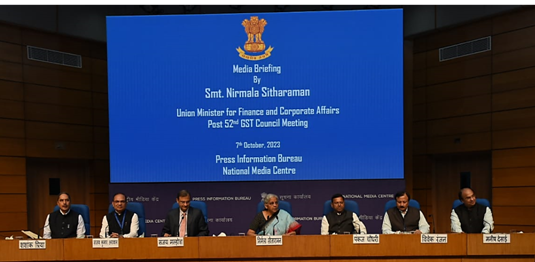

The 52nd Goods and Services Tax (GST) Council Meeting, held on October 7, 2023, was a significant event for India's tax landscape. Under the Chairpersonship of Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman, the meeting witnessed several critical recommendations aimed at streamlining the GST framework, enhancing trade, and driving economic growth. In this article, we'll delve into the key recommendations and their implications.

| Section |

|---|

| 1. Introduction |

| 2. Background |

| 3. Key Findings |

| 4. Modus Operandi of Tax Evasion |

| 5. Lack of Invoices and Accounting Records |

| 6. Income Tax Regulations |

| 7. Suspicious Transactions |

| 8. Conclusion |

Amendments to GST Appellate Tribunal Conditions:

The GST Council recommended amendments to the conditions for appointing Presidents and Members of the proposed GST Appellate Tribunals. These changes aim to improve the efficiency and effectiveness of the appellate process. Tax practitioners and businesses should stay updated with these amendments to navigate the appeals process effectively.

Nil GST Rate for Millet Flour:

In a move that supports health-conscious consumers and promotes millet cultivation, the GST Council proposed a nil GST rate for food preparations of millet flour containing at least 70% millet by weight when sold in loose form. For pre-packaged and labeled forms, a 5% GST rate is recommended. This not only encourages the consumption of nutritious millet but also benefits the millet farming sector.

Exclusion of Extra Neutral Alcohol (ENA) from GST:

Extra Neutral Alcohol (ENA) used in the production of alcoholic liquor for human consumption has been excluded from GST. This change simplifies the taxation structure for the alcohol industry and is likely to have implications for pricing and taxation policies within the sector.

Reduced GST on Molasses:

The GST Council's decision to reduce the GST rate on molasses from 28% to 5% is a welcome relief for cane farmers. This move will expedite the clearance of dues to farmers and reduce the cost of manufacturing cattle feed. Industries dependent on molasses, such as the distillery and cattle farming sectors, should closely monitor this development.

Conditional IGST Exemption for Foreign-Flag Vessels:

As a means of promoting tourism and the maritime industry, the GST Council recommended conditional and limited-duration Integrated Goods and Services Tax (IGST) exemptions for foreign-flag vessels when they convert to coastal runs. This will make India more attractive to international cruise lines and further boost the tourism sector.

Recommendations relating to GST rates on goods and services

I. Changes in GST Rates

A. GST Rate Changes on Goods

-

Millet Flour and Food Preparation: The GST Council introduced a new tax structure for food preparation of millet flour. It will now be taxed at 0% when sold in loose form and 5% when sold in pre-packaged and labeled form. This move encourages the consumption of millet-based products.

-

Imitation Zari Thread: The Council clarified that imitation Zari thread made from metalized polyester/plastic film is covered under the 5% GST rate. However, there will be no refund for the polyester film due to inversion.

-

Exemption for Foreign-Going Vessels: Foreign-going vessels converting to coastal run may be conditionally exempted from IGST, subject to specific conditions. This measure is set to boost coastal shipping and the tourism industry.

B. Other Changes in Goods

-

Exclusion of Extra Neutral Alcohol (ENA): Extra Neutral Alcohol (ENA) used for manufacturing alcoholic liquor for human consumption will be excluded from the ambit of GST, simplifying the tax structure for alcoholic beverages.

-

Reduction in GST on Molasses: The Council recommended reducing GST on molasses from 28% to 5%. This move is expected to increase liquidity for mills, facilitate the faster clearance of dues to sugarcane farmers, and reduce the cost of manufacturing cattle feed.

-

Tariff Code for Rectified Spirit: A new tariff HS code has been introduced for rectified spirit for industrial use, which will be taxed at 18% GST.

C. GST Rate Changes on Services

- Services to Government Authorities: Services provided to Central/State/UT governments, local authorities, and governmental bodies entrusted with various functions will continue to be exempt from GST. This includes services related to water supply, public health, sanitation, conservancy, solid waste management, and slum improvement.

Amendments in GST Laws and Procedures

Alignment with the Tribunal Reforms Act

The GST Council recommended amendments in the CGST Act, 2017, to align with the provisions of the Tribunal Reforms Act, 2021, for the appointment of the President and Member of the proposed GST Appellate Tribunals. Key changes include:

- Eligibility criteria for judicial members.

- Minimum age for appointment as President and Member.

- Maximum age for holding the respective positions.

Amnesty Scheme for Appeals

An amnesty scheme was proposed for taxpayers who couldn't file appeals within the specified time frame. Under this scheme:

- Taxable persons can file appeals against demand orders passed on or before March 31, 2023, until January 31, 2024.

- A 12.5% pre-deposit of the disputed tax amount is required, with 2.5% to be debited from the Electronic Cash Ledger.

Clarifications on Taxability

- Clarifications were provided regarding the taxability of personal guarantees offered by directors to banks.

- Rules for the taxability of corporate guarantees provided between related parties were established.

Automatic Restoration of Provisionally Attached Property

The Council recommended an amendment for automatic restoration of provisionally attached property after one year, simplifying the process and reducing administrative overhead.

Clarifications on the Place of Supply

The Council recommended issuing a circular to clarify the place of supply for various services, including transportation of goods, advertising services, and co-location services.

Export of Services Clarifications

A circular will be issued to clarify the admissibility of export remittances received in a Special INR Vostro account for the purpose of considering the supply of services as an export of services.

Supplies to Special Economic Zones (SEZ) Amendments

Amendments in Notification No. 1/2023-Integrated Tax dated July 31, 2023, will allow suppliers to SEZ developers or units to make supplies of goods or services for authorized operations, subject to integrated tax, with a refund mechanism.

Implications and Benefits

- The changes in GST rates aim to boost the consumption of millet-based products, promote coastal shipping, and reduce the cost of manufacturing cattle feed.

- The amendments in laws and procedures simplify compliance, facilitate appeals, and ensure better tax administration.

- The focus on export remittances and SEZs will likely enhance India's international trade capabilities.

FAQ

Q1: What is the significance of the 52nd GST Council Meeting?

A1: The 52nd GST Council Meeting introduced key recommendations related to GST rate changes, trade facilitation measures, and procedural amendments, which can have a substantial impact on businesses and the economy.

Q2: Can you explain the impact of the nil GST rate on millet flour?

A2: The nil GST rate for millet flour aims to promote healthier dietary choices by providing incentives for the consumption of millet-based products.

Q3: How will the reduction in GST on molasses benefit sugarcane farmers?

A3: The reduction in GST on molasses from 28% to 5% will increase liquidity for sugar mills and expedite the clearance of pending dues to sugarcane farmers, providing them with financial relief.

Q4: What is Extra Neutral Alcohol (ENA), and how does its exclusion from GST impact the liquor industry?

A4: ENA is used in the production of alcoholic beverages. Its exclusion from GST simplifies the taxation process in the liquor industry, potentially reducing costs and administrative complexities.

Q5: How does the conditional IGST exemption for foreign-going vessels promote coastal tourism?

A5: This exemption incentivizes foreign-flagged foreign-going vessels to convert to coastal run, which can boost coastal tourism, benefiting both the tourism industry and travelers.

Q6: What is the Amnesty Scheme introduced in the 52nd GST Council Meeting?

A6: The Amnesty Scheme allows taxpayers to file appeals against demand orders that couldn't be filed within the allowable time frame, offering them a chance to resolve disputes and potentially reduce their tax liabilities.

Q7: Can you provide more details about the clarity on the taxability of guarantees?

A7: The GST Council has clarified the taxability of personal guarantees offered by directors to banks and corporate guarantees provided to related entities. This ensures fair taxation and provides clear guidelines for these transactions.

Q8: How do the place of supply clarifications reduce ambiguity in tax compliance?

A8: The clarifications regarding the place of supply for various services simplify tax compliance for businesses, providing them with a clear framework for determining their tax obligations.

Q9: What does the mandatory ISD procedure entail, and why is it recommended?

A9: The Input Service Distributor (ISD) procedure will become mandatory for distributing Input Tax Credit (ITC) in specific situations, ensuring equitable distribution of credits and streamlining compliance for businesses.

Q10: How can businesses prepare for these changes recommended by the 52nd GST Council Meeting?

A10: Businesses should closely monitor updates and notifications from the GST Council, update their tax compliance processes, and seek professional advice to adapt to these changes effectively.

Conclusion

The 52nd GST Council Meeting brings several significant changes aimed at simplifying tax structures, promoting specific industries, and streamlining compliance. These recommendations, once implemented, will have far-reaching implications for both taxpayers and the broader Indian economy.